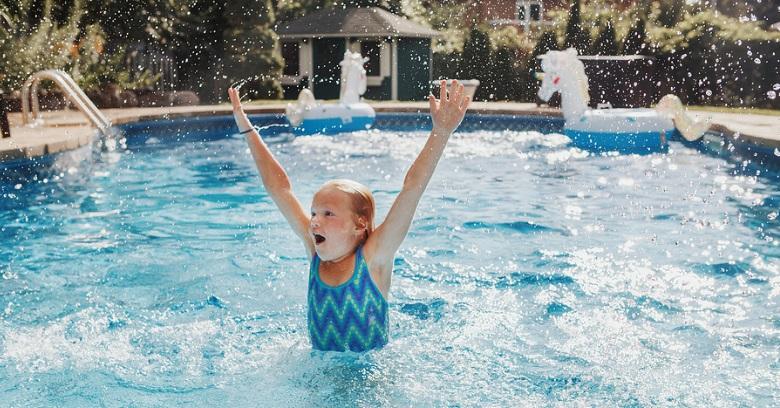

Summer is around the corner and with the rising temperatures, Texans are taking to their swimming pools; however, is it adequately covered by homeowners insurance?

If you do have a pool, you need a good policy from a home owners insurance agency that understands the issues that swimming pools present and what coverage is needed for the policy to be protective.

Read over these important points and then contact an insurance agent who can design a homeowners policy that includes the correct coverage for that swimming pool.

Swimming Pools Are A Significant Insurance Concern

Commonly called “attractive nuisances” by home owners insurance agencies, swimming pools can be more of an inconvenience than one might think.

Home swimming pools present a considerable liability risk to the homeowner, since the possibility of someone being injured or drowning is significant.

While they are a lot of fun, they also attract attention in ways that can be dangerous, especially to children and pets.

Therefore, those owning pools must carry adequate homeowners insurance that explicitly covers the pool in order to protect themselves and anyone who may become injured in or around the pool.

What Insurance Is Needed For A Swimming Pool?

If you have a swimming pool at home, there are two kinds of coverage that an experienced homeowners insurance agent should include in your home policy.

1. First and most importantly, the policy should include liability coverage and expanded coverage at that.

The standard $100,000 or so that most homeowners insurance policies include is far from protective against pool accidents.

Your insurance agency may suggest increasing the liability amount to as high as $500,000 or more.

Be aware that raising the liability coverage this significantly will result in an increase in the insurance premium.

2. Secondly, the policy purchased from your insurance agent should also include damage coverage by listing the pool as covered personal property.

Whether the pool is above ground or inground, be sure the policy identifies it specifically as covered property.

Adding a pool as covered personal property may or may not raise the insurance premium, as it depends on how much coverage you already have.

Be Aware of Additional Pool-Related Insurance Issues

Another factor to consider when taking out a homeowners policy that provides adequate liability and damage coverage is Added Risks and what home owners insurance agencies consider to be non-coverable events.

Essentially, to provide coverage for your pool, the agency will likely present a list of rules that must be followed in order to reduce the possibility of an accident.

Such rules might include having a locking fence around the pool and not allowing kids to swim without adults present.

Failure to adhere to the company’s policy rules regarding coverage could result in a non-covered loss.

Your Pool Needs The Right Homeowners Insurance

A swimming pool in the backyard is the perfect escape for the sweltering heat during Texas summers.

A pool that is not covered by the right type or amount of homeowners insurance is a danger to everyone who may swim in it.

Before you open the pool this summer, talk to a homeowners insurance agent at a firm that routinely insures private pools to ensure you have all the protection needed to enjoy stress-free swimming this season!